Documents Required for Customs Clearance in Dubai

Customs clearance in Dubai refers to the process of completing the necessary procedures and documentation required by Dubai Customs to facilitate the entry or exit of goods into or out of the country. It ensures that goods comply with customs regulations, including payment of applicable duties, taxes, and adherence to trade policies. If you are importing goods into the emirate, you need the following documents for a smooth and prompt Dubai customs clearance procedure.

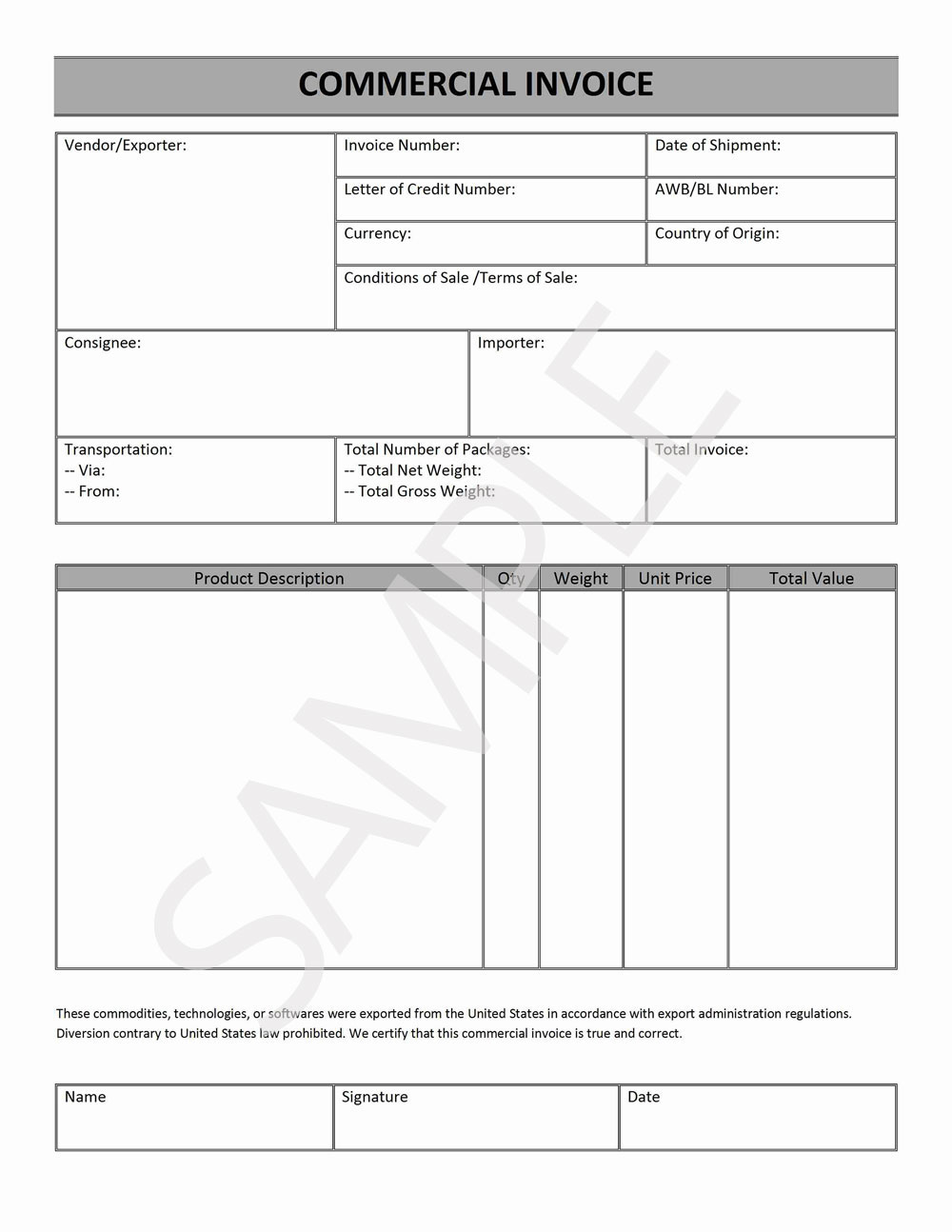

Commercial Invoice

The commercial invoice is a detailed document provided by the exporter to the importer and customs authorities. It contains important information such as the following:

- Seller’s Information – The exporter’s full name, address, and contact details

- Buyer’s Information – The importer’s full name, address, and contact details

- Invoice Number – A unique identifier designed to track the transaction

- Date of Issue – The date of the invoice’s issuance

- Description of Goods – Detailed description of the products, including unit price, weight, and quantity

- Total Value – The total value of the goods being shipped, including the currency used

- Terms of Sale (Incoterms) – Outlines the shipping and payment terms, such as or CIF (Cost, Insurance, and Freight) or FOB (Free on Board)

- Shipping Details – Method of transport (air, sea, land), and shipping date

- Country of Origin – Where the goods were produced or manufactured

- Payment Terms – Outlines when and how payment is to be made (e.g., 30 days after shipment).

- Currency of Transaction – The currency used for the transaction.

- Signature – The exporter’s authorized signature, certifying the accuracy of the document.

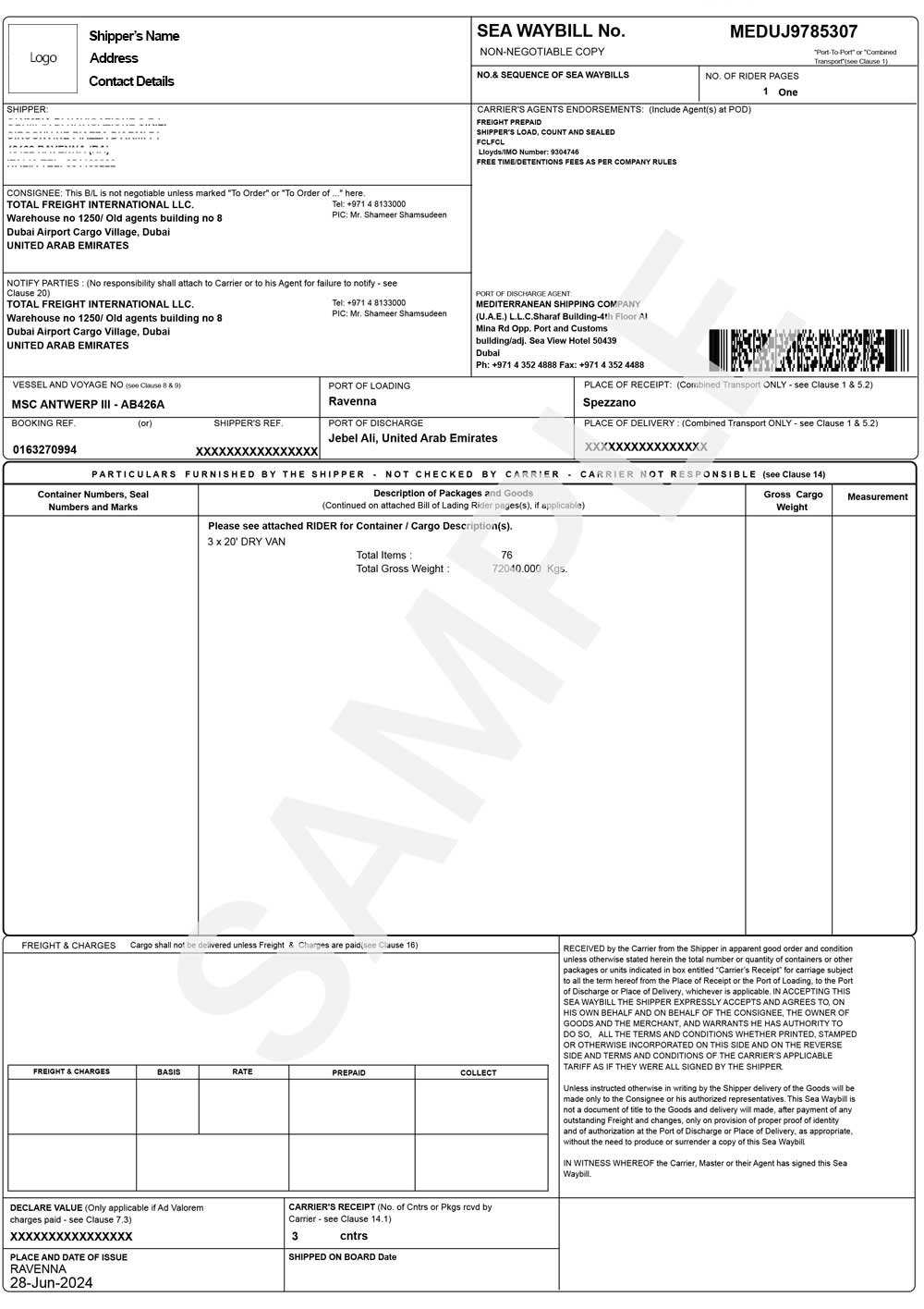

Bill of Lading

The Bill of Lading (BOL) is an essential document in the shipping process via sea. It serves as a document of title, a receipt for the goods, and a contract for their carriage. It must be completed accurately and must include details such as the consignor and consignee, goods description, shipping details, and shipment terms.

The following are some of the core functions of the Bill of Lading:

- Contract of Carriage – It outlines the terms and conditions under which the carrier agrees to move the goods from the point of origin to the destination. This includes details like the type of goods, the agreed-upon method of shipping, and responsibilities during transit.

- Receipt for Goods – This document serves as an acknowledgement that the carrier has received the goods from the shipper as per the condition described. It also acts as proof that the cargo will be delivered as agreed upon.

- Document of Title – The BOL can be used to transfer the goods’ ownership while they are in transit. The holder of this document has the legal right to claim the goods at the destination.

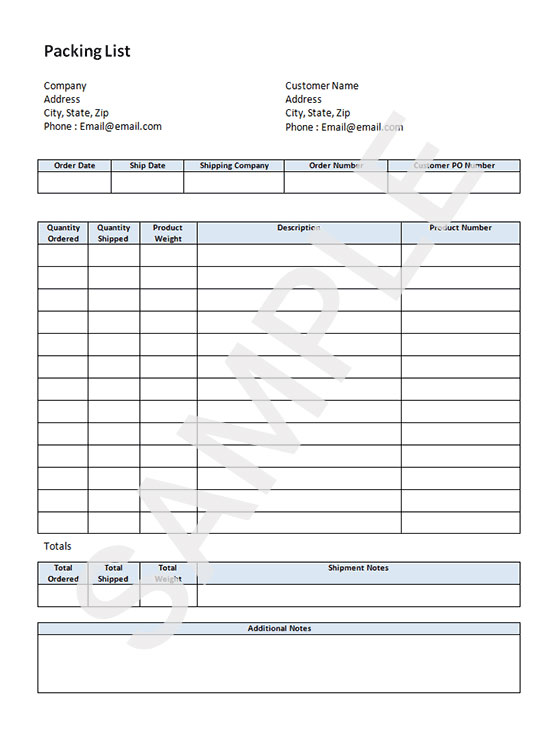

Packing List

The packing list outlines comprehensive information about the contents of every package in the shipment. It includes the goods’ weight, dimensions, and description, as well as the number of packages and packaging type. This document enables customs officials to easily verify the shipment’s contents against the commercial invoice.

This document also offers the following benefits:

- Accuracy and Accountability – Ensures that the correct items are shipped and received, reducing the risk of errors.

- Customs Compliance – Assists customs in identifying and inspecting goods for regulatory purposes, including tariffs and duties.

- Logistical Management – Helps shippers, freight forwarders, and recipients keep track of what is being moved at different stages of the shipping process.

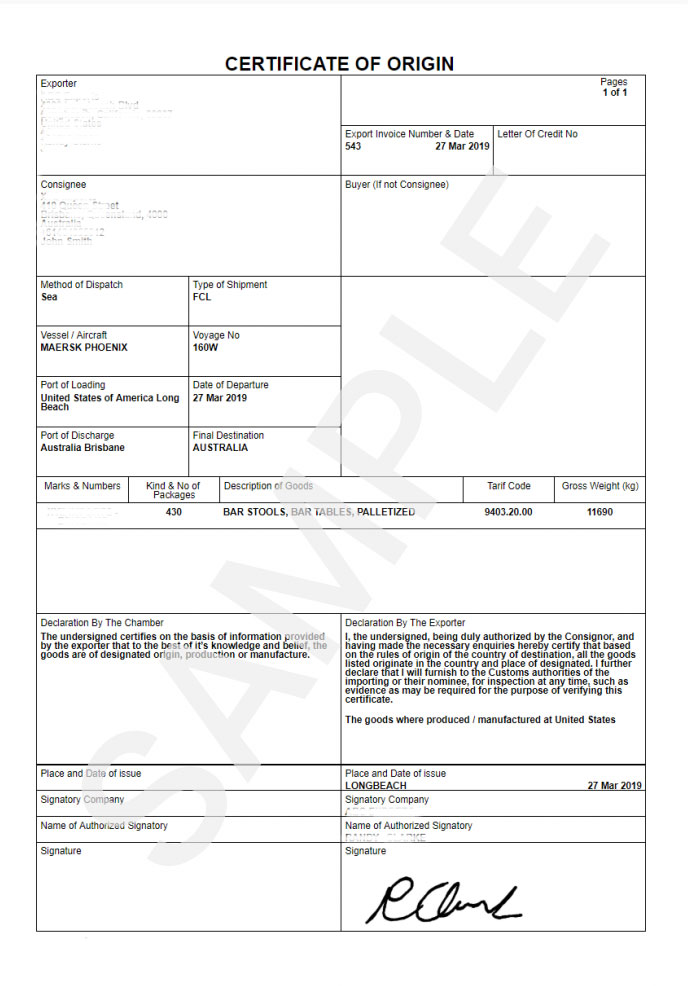

Certificate of Origin

The Certificate of Origin (COO) is a document that certifies the country in which the goods were produced. It is critical for determining the applicable tariffs and duties, as well as for complying with trade agreements. An authorized body, such as a chamber of commerce, issues this document.

The Certificate of Origin is used in the following:

Customs Clearance – Customs authorities in the importing country use the COO to assess whether the goods qualify for preferential tariffs under trade agreements or if any restrictions or duties are applicable.

Trade Agreements – Several countries have trade agreements (FTAs) also known as preferential trade agreements. The CO enables importers to benefit from reduced tariffs or exemptions if the goods comply with the rules of origin specified in these agreements.

Proof of Origin – The COO acts as an official document verifying the origin of the goods, ensuring that the products adhere to the trade laws and regulations of the importing country.

Consumer Assurance – Consumers may require or prefer certain goods to be manufactured in a specific country due to ethical sourcing, safety, or quality standards. This is assured by the COO.

Import/Export License

Businesses involved in importing or exporting goods in Dubai must have a valid import/export license issued by the relevant authorities. This license authorizes the company to engage in trade activities and is a prerequisite for customs clearance.

Here are the key aspects of an import/export license:

Regulatory Compliance – The license ensures that importers and exporters adhere to relevant laws and regulations governing the trade of goods. It may involve compliance with safety standards, quality controls, and other regulatory requirements.

Legal Authorization – It grants legal permission to conduct international trade activities. Without this license, businesses may be prohibited from importing or exporting specific goods.

Trade Restrictions and Controls – The license helps enforce trade restrictions or quotas on certain products, which may be in place for reasons such as national security, economic protection, or environmental concerns.

Documentation – It provides a formal record that the business is authorized to handle international trade transactions, often required for customs clearance and other regulatory procedures.

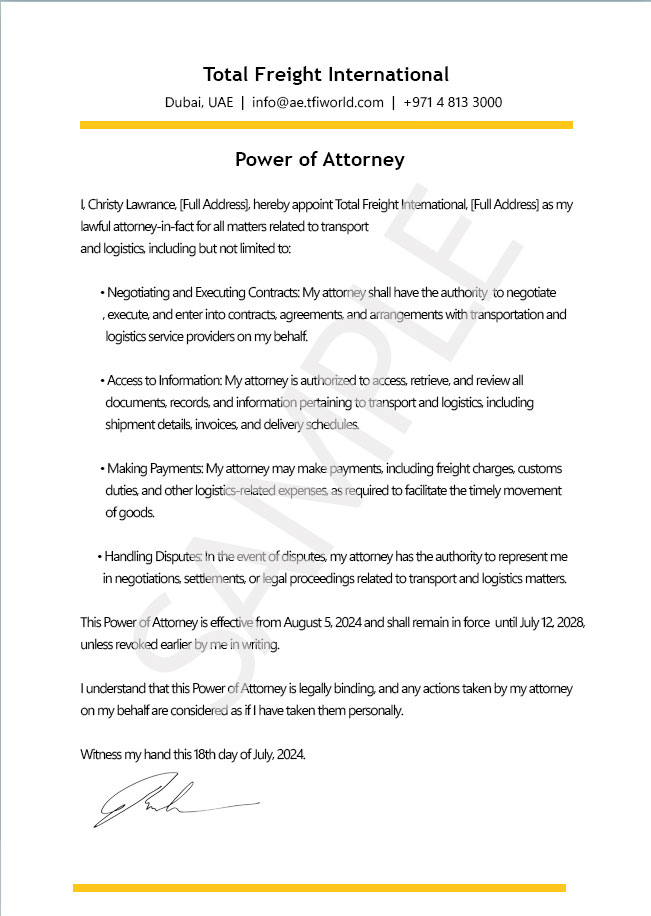

Power of Attorney

If you are using a customs broker or agent to handle the Dubai customs clearance procedure on your behalf, you may need a power of attorney document authorising them to act on your behalf.

Here are the reasons:

- Legal Authorization – Provides the customs broker with legal authority to act on behalf of the client, ensuring that all customs processes are managed correctly.

- Efficiency – Facilitates the smooth and efficient handling of customs procedures, reducing delays and ensuring compliance with regulations.

- Delegation – Allows clients to delegate complex customs tasks to professionals, enabling them to focus on their core business activities.

Depending on the nature of the goods and specific requirements, additional documents such as permits, licenses, or certificates may be necessary. It is advisable to check with the customs authorities or a customs broker to determine any specific documentation requirements for your shipment.

Customs clearance Dubai requirements may vary based on the type of goods, country of origin, and specific regulations in place at the time of importation. Hence, having a professional and experienced customs broker to work on your behalf is a crucial investment.

At TFI, our in-house team of certified experts will walk you through the Dubai customs clearance procedure with ease. Backed by our expertise and strong relationship with the local customs authorities, you can rely on to make your import journey a success.